nanny tax calculator florida

File this application to establish a Reemployment Tax. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Nanny Tax Requirements By State Care Com Homepay

Were here to help.

. Your average tax rate is 165 and your marginal tax rate is 297. These taxes are collectively known as FICA and must be withheld from your nannys pay. That means that your net pay will be 45925 per year or 3827 per month.

Your average tax rate is. Fill in the salary How often is it paid. Nannytax Payroll Services for UK Employers - Nannytax.

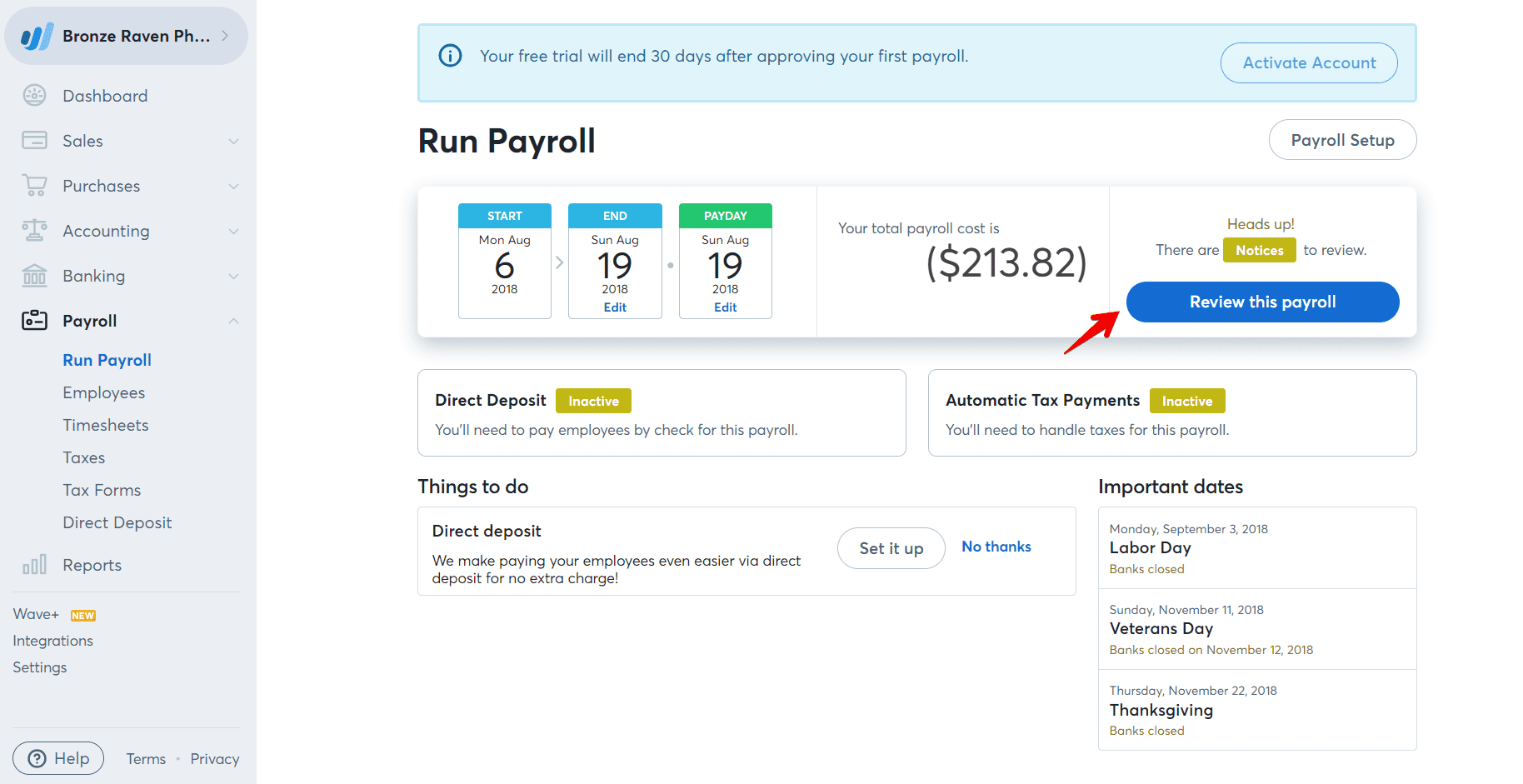

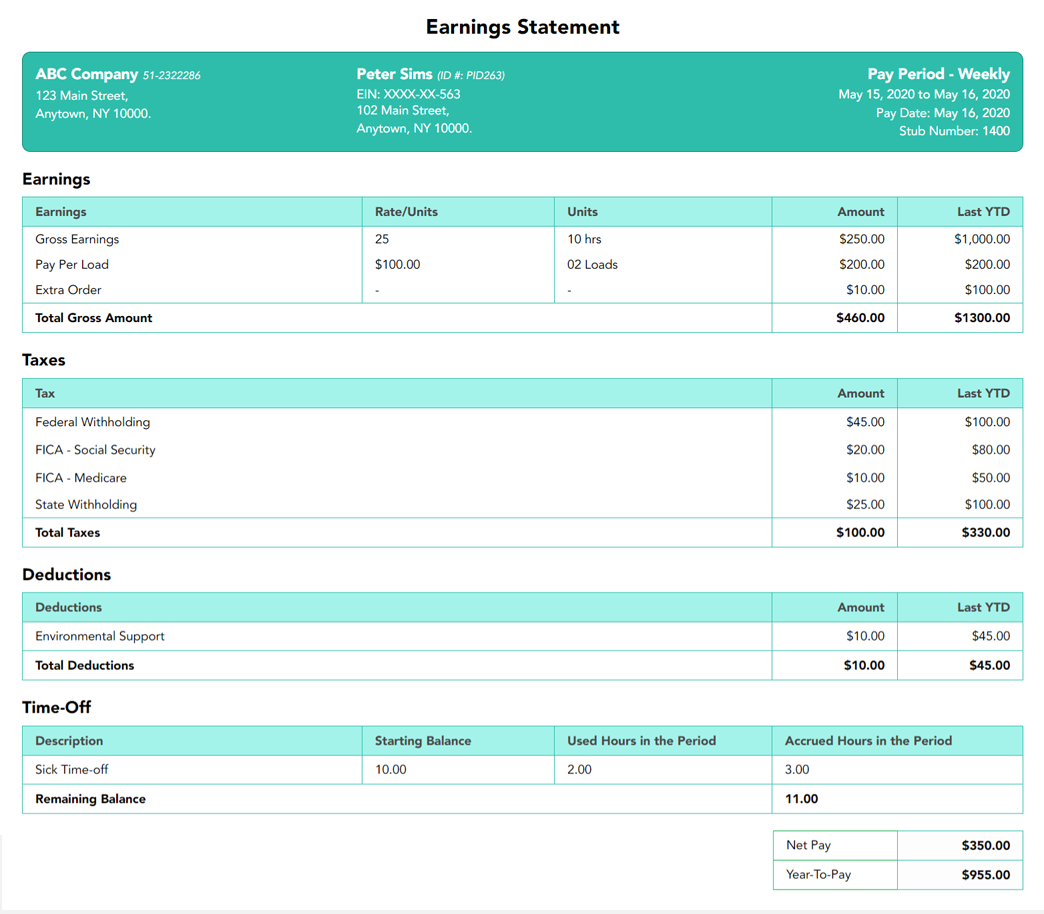

Taxes Paid Filed - 100 Guarantee. Easy-to-use nanny tax calculator provides estimate of tax responsibility for a householder employer and tax withholdings for nanny or other domestic worker. Our nanny tax calculator will help you to calculate nanny pay and determine your tax responsibility as a household employer whether paying a nanny a senior care worker or other household.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Nanny Tax Calculator Use GrossNet to estimate your federal and state tax obligations for a household employee. For example if your nanny.

What Is Fica What Is Fica On My Paycheck What Is Fica Meaning Surepayroll How To Pay Your Nanny S Taxes Yourself. If you make 55000 a year living in the region of Florida USA you will be taxed 9076. Ad Easy To Run Payroll Get Set Up Running in Minutes.

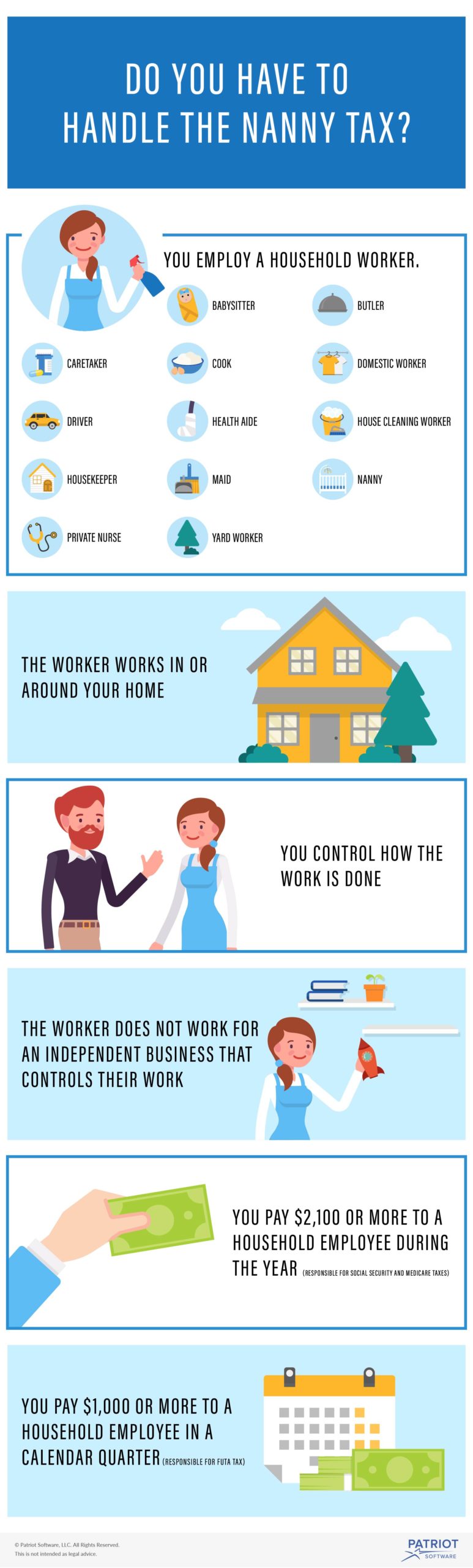

Nanny tax calculator florida Sunday March 20 2022 Edit. The Nanny Tax Calculator This calculator will help you understand the total cost of employing a nanny and how much the nanny will take home. FLORIDA LABOR LAWS Minimum Wage.

Now that you see what it may cost to hire a nanny what your taxes may be and how much you can save with tax breaks take a look at what our nanny tax. Nanny Tax Calculators Please use one of our two nanny tax calculators to determine the correct wages and withholdings for both hourly and salaried employees. Florida Paycheck Calculator - SmartAsset.

Florida defers to the FLSA which requires that all domestics excluding companions be paid at no less than the greater of the state or federal. Simply multiply your nannys gross wages by 765 to get your FICA tax responsibility. Ad Easy To Run Payroll Get Set Up Running in Minutes.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Nanny Tax Calculator - Nanny Pay Calculator - The Nanny Tax Company Nanny Tax Hourly Calculator Enter your employees information and click on the Calculate button at the bottom of. If you pay your nanny cash wages of 1000 or more in a calendar quarter or 2400 in a calendar year file Schedule H.

For example if your nanny grosses 800week then your FICA tax for that pay. Taxes Paid Filed - 100 Guarantee. Social Security taxes will be 62 percent of your nannys gross before taxes wages and Medicare.

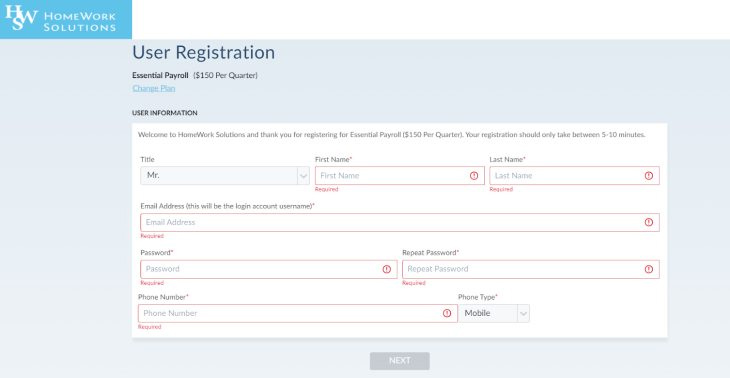

Good news though NannyPay offers a low-cost and up-to-date software solution for calculating nanny taxes and preparing annual Form W-2s and Schedule H up to 3 employees at no. Nanny Tax Calculator GTM Payroll Services Inc.

![]()

Florida Nanny Tax Rules Poppins Payroll Poppins Payroll

Free Paystub Generator For Self Employed Individuals

Ohio Paycheck Calculator Smartasset

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

5 Best Nanny Payroll Services 2022

Guide To Paying Nanny Taxes In 2022

Free Hourly Payroll Calculator Hourly Paycheck Payroll Calculator

Can I Deduct Nanny Expenses On My Tax Return Taxhub

14 Steps To Nanny Tax Compliance For Household Employers

Florida Hourly Paycheck Calculator Gusto

Nanny Taxes Guide How To Easily File For 2021 2022 Sittercity

Nannychex Hourly Paycheck Calculator

Ohio Paycheck Calculator Smartasset

Your Nanny Tax Responsibilities As An Employer Rules More

Household Employment Blog Nanny Tax Information Calculate Nanny Payroll Tax

5 Best Nanny Payroll Services 2022